About Us / Free Resources / CD STRATEGY CALCULATOR

Certificates of Deposit (CDs) are one of the instruments for no-risk, fixed income investment. There are many strategies, such as laddering, that are used to try to optimize returns while protecting against fluctuations in interest rates. In recent years, there has been a very small range of interest rates from lowest to highest, across different terms (months to maturity). So, there was little a CD investor could do to affect the overall return. But now,, with interest rates start to rise, with varying term lengths determining the interest rates, strategies have become important once again.

One strategy we've employed is quite simple... purchase breakable CDs with highest interest rates, usually those with the longest maturity terms (usually 5 years). Breakable CDs are CDs that can be cashed in before the maturity date with a penalty. The penalties are generally from 3 to 12 months of interest. If at a later date, interest rates have increased, then it may be worthwhile to break the original CDs and repurchase new CDs at the higher rate.

This strategy is similar to, but the convberse of, refinancing a mortgage when interest rates drop.

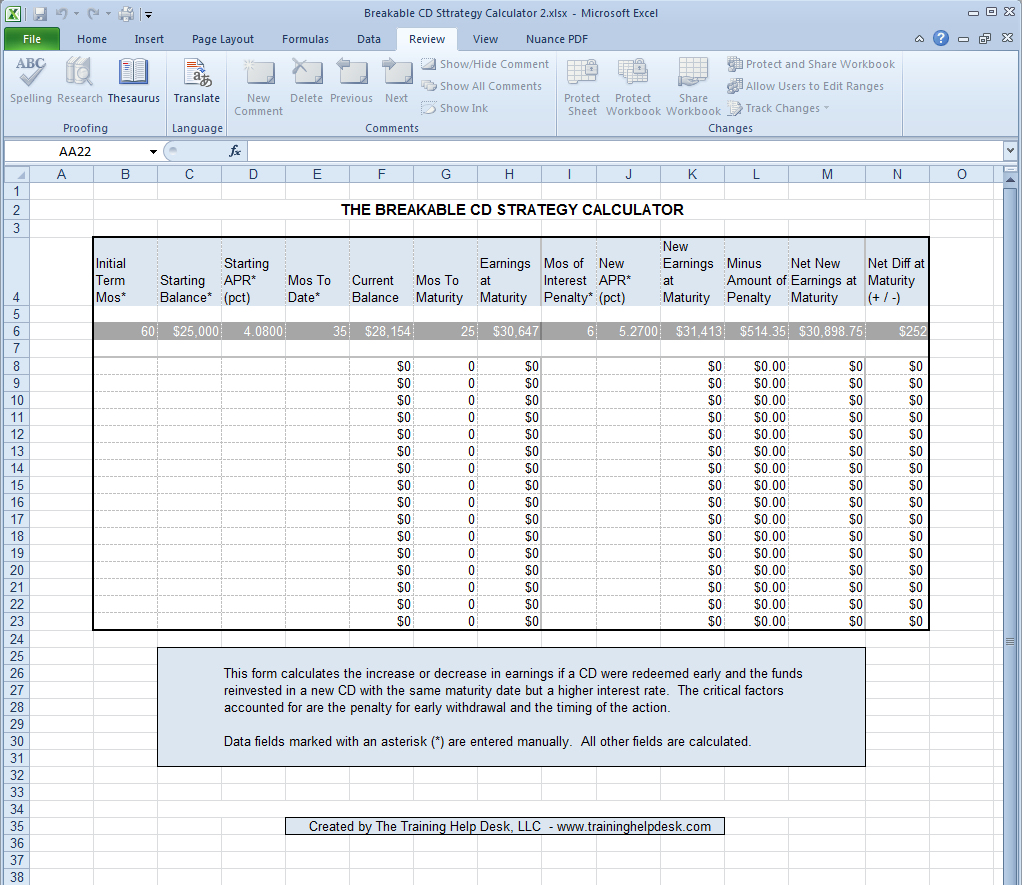

We have developed an Excel spreadsheet that will tell you what the difference in overall return would be at any point in the term of the CD if it were broken and the proceeds reinvested in a new CD at a higher rate.

You must have MS Excel installed in order to open and read this file.